Email: [email protected]

When purchasing a home, it’s crucial to secure funding before entering into the transaction portion of the buying process. Typically, many homeowners go for a conventional loan, which is standard for most home types. But what about unconventional homes, such as a modular home, mobile home or even manufactured home?

Can you get this type of home with a conventional loan like a VA (Veterans Affairs) loan, FHA (Federal Housing Administration) loan or conventional loan? What about a personal property loan?

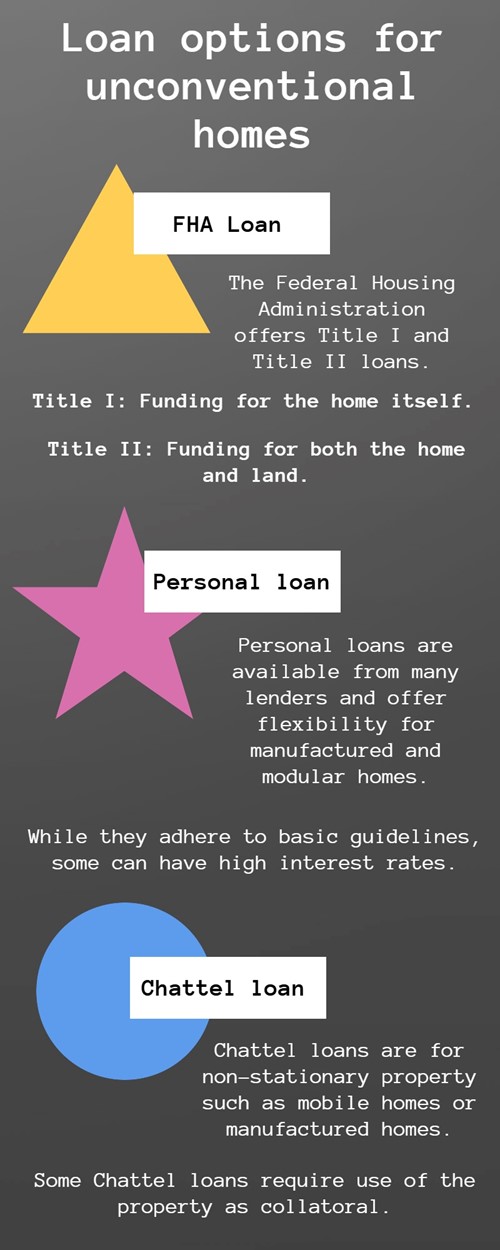

Here are three ways to secure funding for your unconventional home:

FHA loans are typically a popular option for those just starting their homebuying journey, first-time homebuyers and a slew of other potential homebuyers. Those searching for loans for mobile home options or manufactured home options may find peace of mind here.

FHA loans offer potential mobile homeowners either a Title I or Title II loan. Title I loans allow the prospective homeowner to simply borrow for the home, assuming all requirements are met. Homeowners who already have a mobile residence may be able to apply for this loan if they need to maintain or repair their home as well.

Title II loans help the buyer purchase the plot of land as well as the home being placed on it. These loans may have conventional term limits of 30 years, whereas Title I loans tend to max out at 20 years. Because of the stricter requirements of a Title II loan, most mobile homes won’t qualify due to being built before June 1976. Manufactured homes, however, will.

FHA loans used to secure these unconventional home types still require that home to be the borrower’s primary residence for approval.

Personal loans are a great way to circumvent numerous issues with conventional loans when it comes to mobile home loans, manufactured home loans and modular home loans. Personal loans are offered by a vast array of lenders, with some offering loans as high as $100,000.

Since personal loans are so flexible, they tend not to adhere to basic guidelines for unconventional homes. However, be wary of their interest rates. These loans can add up over time, so it’s best to review the terms, interest rates and monthly payments against your own financial plan.

Chattel loans are typically offered for property that isn’t stationary, such as a mobile home or manufactured home. These loans typically require the borrower to enter into an agreement with the lender stating the residence or movable property are to be used as collateral in securing the loan.

While these may have more fees and risk associated with them, they are typically a good option for those in need of financing. For those with some financial restrictions, there are chattel loans with federal backing that may help you secure your home.

Be your home stationary or on the move, finding funding is one of the most important parts of the homebuying journey. Be sure to select the loan that’s best for you and your financial situation.

If you have questions about what type of financing, or even property type, to search for, give your agent a call. They’ll be able to help you move in the right direction for your new home.

John is a native Somerville resident and has been a dedicated a real estate sales professional for nearly thirty years. As a strong well respected businessman and former owner of Prudential Buccelli Real Estate, he was thrilled to merge with the Berkshire Hathaway HomeServices Verani Realty brand to expand the global outreach and name recognition for his clients. He has a forward thinking approach, embraces innovation and focuses on all resources to assist his clients. His diverse experience includes residential, commercial, investment land. His experience enables him to understand the challenges of the fluctuations in the real estate industry. John is focused on time tested principles that he has learned on how to produce results and he knows how to respond to the market. He has been involved in thousands of real estate transactions in his long career. Since all real estate is local, he is the area expert!